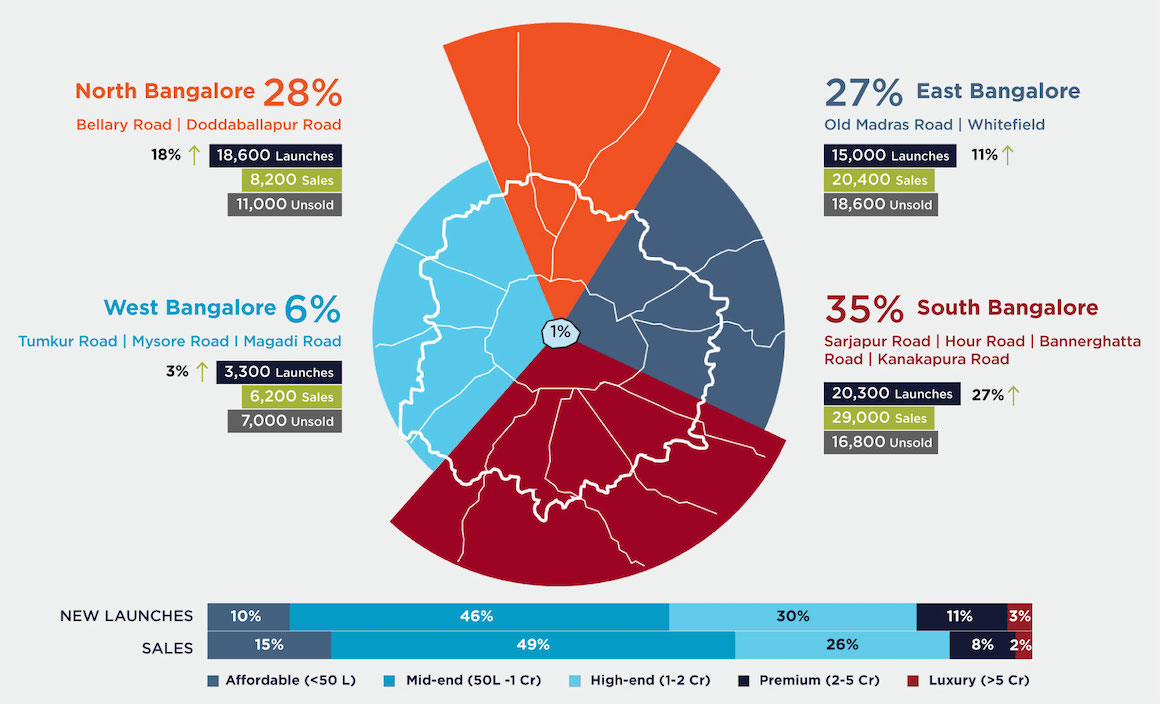

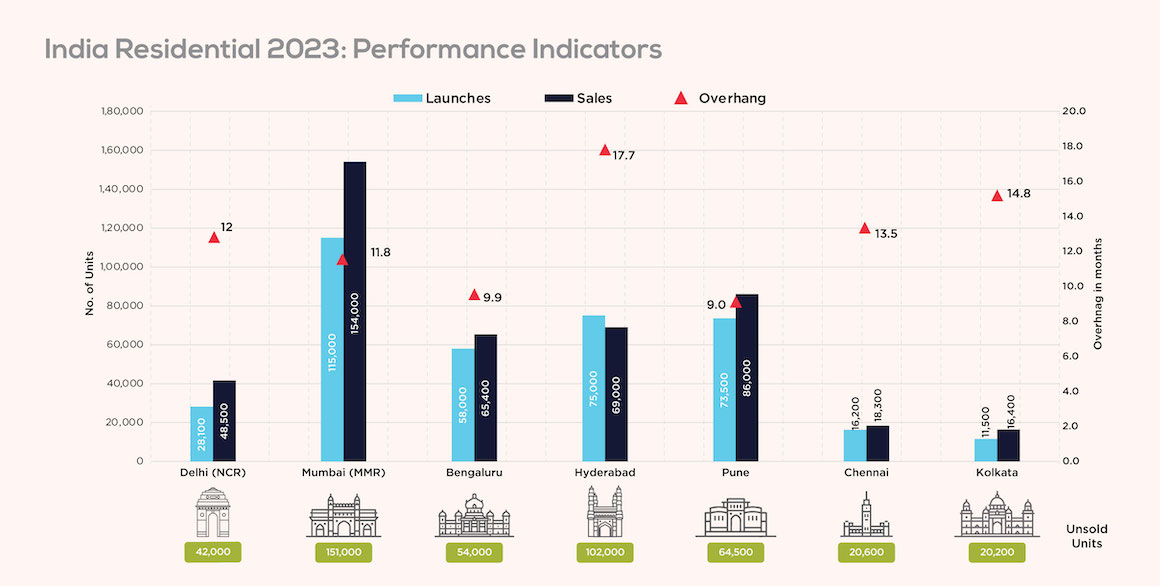

Bengaluru’s residential market grew in 2024, with a 13% rise in supply and a 3% increase in sales. Premium homes (INR 1-2 Cr) led with 40% of sales, while demand for larger units drove a 10% increase in average size. Luxury and Ultra Luxury segments saw strong traction, shaping a dynamic market.

Bengaluru’s residential real estate market experienced remarkable growth in 2024, driven by robust supply and demand dynamics. The city witnessed 65,400 new unit launches, reflecting a 13% increase compared to the previous year. On the demand front, 67,000 units were sold, marking a 3% rise from 2023.

As of December 2024, the unsold inventory stands at 52,200 units, with the inventory overhang reducing to nine months, down from ten months in 2023. Notably, for the first time, the premium segment (INR 1 - 2 Cr) emerged as the most dominant category, contributing 40% of total sales. The mid-segment (INR 0.5 - 1 Cr) followed closely, accounting for 36% of sales.

In terms of typology, 3 BHK units led the market, comprising 54% of the total supply, while 2 BHK units made up 32%. Additionally, the average unit size increased by 10%, rising from 1,480 Sq.ft. in 2023 to 1,600 Sq.ft. in 2024, underscoring homebuyers’ growing preference for more spacious living.

Premium Segment: The premium segment (INR 1 - 2 Cr) witnessed strong traction, with approximately 30,100 units launched, accounting for 46% of the city’s total supply. Demand surged by 58%, with over 26,900 units sold, making it the most dominant price category. This segment’s share of total sales rose from 26% in 2023 to 40% in 2024. Notably, 3 BHK units comprised 70% of total absorption, reflecting a growing preference for spacious homes. Given the strong demand, the inventory overhang in this segment is currently just 7 months.

Mid Segment: The mid segment (INR 0.5 - 1 Cr) accounted for 30% of Bengaluru’s supply, with over 19,600 units launched in 2024. However, sales declined by 25% compared to 2023, leading to a drop in this segment’s share of total demand from 49% in 2023 to 36% in 2024. Despite this decline, it remained one of the most sought-after categories, with 2 BHKs comprising 55% of total sales. The segment currently holds 21,400 unsold units, resulting in an inventory overhang of 11 months.

Luxury and Ultra Luxury Segments: Luxury Segment (INR 2 - 5 Cr): Sales surged by 68%, with 9,300 units sold in 2024, reflecting increasing demand for high-end living. Ultra Luxury Segment (> INR 5 Cr): Demand grew by 42% compared to 2023, as buyers sought premium amenities and superior specifications. 3 BHKs and 4 BHKs dominated sales, accounting for 54% and 40%, respectively. The inventory overhang for units priced above INR 2 Cr stands at 7 months, with 5,700 unsold units.

Affordable Segment: The affordable segment (< INR 50 Lakhs) contributed just 5% of the city's supply, with 3,300 new units launched in 2024. Demand continued to decline, with sales dropping 45% year-on-year to 5,400 units. Its share in total demand fell from 15% in 2023 to 8% in 2024, reflecting a significant contraction. With demand waning, this segment faces a substantial inventory overhang, signaling a shift in Bengaluru’s affordability dynamics.

Outlook

- The growing preference for larger homes is expected to drive a 7-8% increase in average unit sizes by 2025.

- The premium, luxury, and ultra luxury segments will continue their upward trajectory, fueled by evolving lifestyle aspirations and higher disposable incomes. Additionally, the share of Grade A supply will expand to meet rising demand in these segments.

- The mid-segment is expected to stabilize as developers fine-tune their offerings in response to shifting buyer preferences.

- With steady price appreciation and increased demand for spacious homes, the sub-INR 50 lakh price segment is likely to phase out. As a result, Bengaluru’s affordable housing benchmark may shift, redefining the INR 50 lakh to INR 1 crore range as the new affordable segment in coming years.

Bengaluru’s residential real estate market demonstrated resilience and dynamism in 2024, marked by strong sales momentum, growing demand for premium properties, and a shift toward spacious living. As the city continues to evolve, these trends signal a promising outlook for both homebuyers and investors in the years ahead.