11th July 2024

Green leasing is an innovative approach to real estate lease agreements that integrates environmental, social, and governance (ESG) goals into the contractual relationship between landlords and tenants. It’s a collaborative strategy where both parties commit to sustainable practices, such as energy efficiency, waste reduction, and improved indoor air quality. These leases include clauses with respect to operational duties, sustainable practices, and utility tracking, aiming to reduce a building’s carbon footprint and operational costs.

Overall, green leasing in real estate industry aims to foster a partnership between landlords and tenants to achieve long-term sustainability goals, thereby reducing the building’s carbon footprint and operational costs while promoting environmental responsibility.

Currently, IGBC & LEED are the prominent certifications preferred by the occupiers for Green Buildings, which provide a framework for assessing and certifying the sustainability of buildings. The rating considers various aspects of sustainability, water efficiency, energy efficiency, materials used, indoor environmental quality, innovation in design, etc.

To realise the additional benefits during operational phase, green leasing contracts come into play with clauses pertaining to ESG factors. These leases come in three different shades from Light, medium to dark green clauses.

Light Green: Limited in scope and commitment from both the parties to cover environmental aspects and are not legally abiding

Medium Green: The Scope includes certain obligations on both the parties to cover environmental aspects. But these are not legally abiding.

Dark Green: Legally abiding, require a significant level of commitment and cover a wider scope including environment, social and governance aspects.

Some of the most widely followed green clauses in the country are focused around:

In India, the green clauses are still evolving. Currently, they are generally characterized by light to medium green shades, indicating limited commitment and scope. These clauses primarily focus on improving energy efficiency and include certain commitments towards environmental sustainability from both landlords and tenants. This might involve provisions for energy-efficient appliances, waste management practices, and sustainable building materials. However, these commitments are not as stringent or comprehensive as those found in countries with more advanced green building regulations.

The demand for green leasing is being propelled by the increasing emphasis on ESG goals. As companies integrate ESG factors into their decision-making processes, they seek office spaces that align with their sustainability and net-zero carbon targets. This shift is evident with the significant increase in green-certified office penetration.

Key drivers of this demand include Sustainability goals, Corporate Responsibility, Regulatory Compliance, Cost Efficiency etc. This trend towards green leasing reflects a broader commitment to environmental stewardship and highlights the growing importance of sustainable real estate in corporate strategies.

To date, more than 90% of Grade A developer’s commercial assets are green-certified, as demand towards sustainable Commercial (Office) space has increased from the prominent national & international occupiers.

DLF, ITC Group, Lodha Group and the three REITs of Embassy, Mindspace and Brookfield India are some of the leading institutions who have been at the forefront of adopting sustainable practices with green certification in commercial buildings.

The increase in the adoption of green leases in India is being driven primarily by global initiatives to combat climate change. Owners / Developers are facing mounting pressure to adopt sustainable practices, which is encouraging the inclusion of green clauses in lease agreements. These green leases typically involve commitments to energy efficiency, waste reduction, and other environmentally friendly practices, reflecting a growing awareness and responsibility towards environmental sustainability. This trend aligns with international efforts to reduce carbon footprints and promote eco-friendly practices in the real estate sector.

Enhanced brand image, assured long-term occupancy levels, reduced utility consumption, improved indoor environmental quality, and lower operating costs (between 12%-15%) are major reasons for the adoption of Green Certifications by Grade A developers. These benefits enable them to command a rental premium of 20%-30%.

Additionally, cities like Bangalore and Hyderabad have witnessed ~20% higher occupancy rates among green-certified buildings compared to non-certified buildings. This trend underscores the growing preference for sustainable and energy-efficient office spaces among tenants.

The increasing emphasis on green leasing in real estate industry reflects a broader commitment to sustainability in the real estate sector. As more companies adopt ESG goals, the demand for green leases is expected to continue rising, driving further innovation and investment in sustainable building practices. This trend not only benefits the environment but also provides significant economic and health advantages for both landlords and tenants.

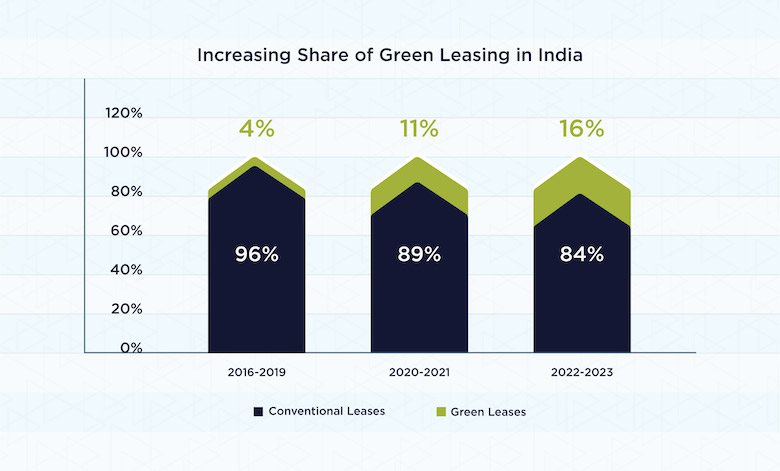

The surge witnessed in green leasing over the last five years reflects the growing demand for sustainable and energy-efficient offices. Consequently, the future demand for green leasing in India is anticipated to reach a share of 20%-25% by the year 2025. This demand is expected to be met primarily by Grade A office stock, as green building certification is poised to become a standard expectation from IT majors and global companies when choosing office locations.

Current green leases are primarily focused on improving energy efficiency and addressing environmental issues. However, it is expected that future leasing practices will also incorporate social and governance aspects to align with comprehensive ESG goals.