Hosur Road is evolving into a premium residential hub, driven by the Yellow Line Metro and rising Grade A developments. Thus, the market is set for 15–20% annual price growth and a sharp rise in end-user demand for the next 2-3 years.

The Hosur Road micro-market in South Bengaluru, encompassing the Electronic City IT hub and Jigani-Bommasandra industrial zone, has remained a hub for blue chip companies such as Infosys, Wipro, TCS, HCL, Tech Mahindra, Bosch, and Biocon. This corporate presence has consistently attracted a large workforce, triggering sustained housing demand in the region.

An improved infrastructure developments such as the Electronic City Elevated Expressway and NICE Road have significantly enhanced connectivity to major parts of Bengaluru. As a result, Hosur Road has rapidly evolved into one of the city’s most sought-after residential corridors. The upcoming Namma Metro Yellow Line (RV Road to Bommasandra)—now in its final phase of construction and slated for full operation by Q4 2025—is expected to further catalyse residential growth.

Notably, the region has experienced a strategic shift in recent years—from a predominantly mid-income housing market to an emerging premium segment. The advent of the Yellow Line has triggered heightened interest from Grade A developers, transforming the area from an investor-driven market to one that increasingly appeals to end-users.

This blog decodes the “Yellow Line Metro Effect”, tracking the evolution of Hosur Road’s residential landscape from the initial announcement to the current advanced construction stage, while offering a forward-looking outlook post metro operation.

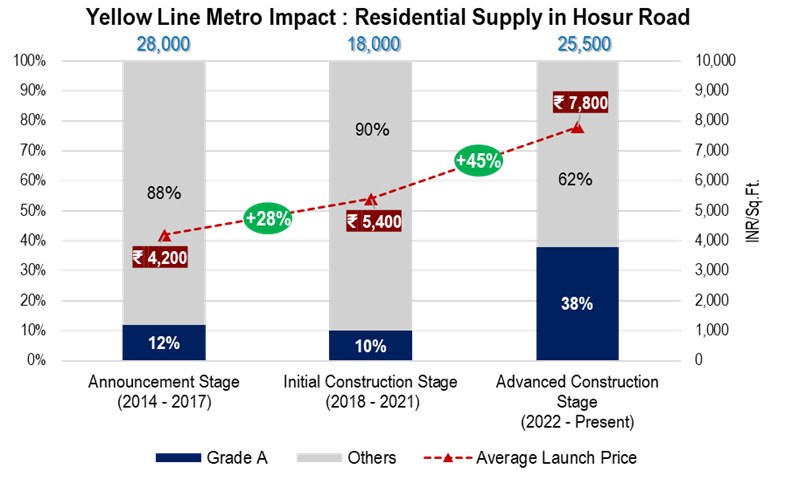

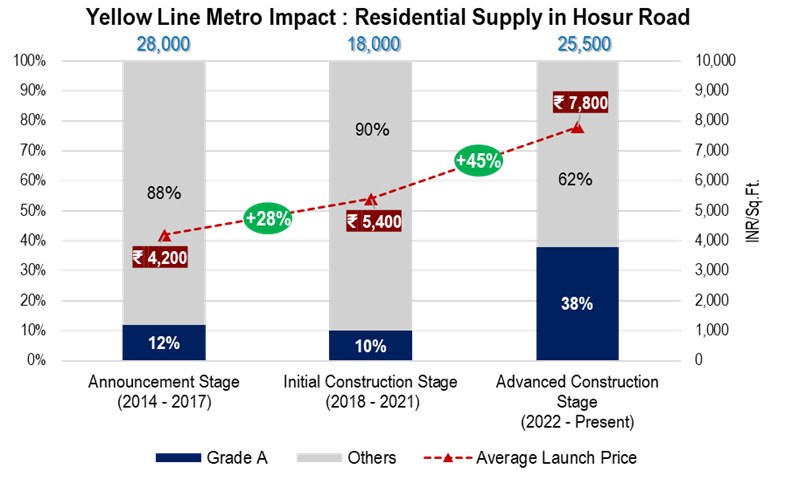

Announcement Stage (2014–2017):

- In January 2014, the project received central government approval, and the foundation stone was laid in 2016. Around 28,000 residential units were launched during this phase, with Grade A developers contributing approximately 12% of the total supply. The market recorded an average annual supply of 7,000 units and absorption of ~ 6,400 units.

- The supply was dominated by 2 BHK units with typical sizes ranging from 1,100 to 1,400 sq.ft., catering primarily to the affordable and mid-segment. Grade A projects recorded up to 50% higher sales velocity than the market average of 80–90 units/project/year.

- Key launches included Prestige Song of the South, Purvankara Westend, Kolte Patil iTowers Exente, and Sattva Cadenza.

Initial Construction Stage (2018–2021):

- Construction commenced in November 2017, gradually boosting the market. This period witnessed the launch of approx. 18,000 units, though the COVID-19 pandemic severely impacted sales and supply, especially in 2020 and 2021. Grade A developments accounted for a modest 10% share of total supply.

- 2 BHK units continued to dominate followed by 3BHK units, with a nominal 4% increase in average unit sizes to 1,100–1,500 sq.ft. Sales velocity dipped sharply to ~60% decline from pre-COVID figures.

- Notable Grade A launches included Sobha Brooklyn Towers & Manhattan Towers, Godrej Nurture, and The Lakeview Address 2.

Advanced Construction Stage (2022 – Present):

- Post-pandemic recovery and robust construction activity have led to the launch of 25,600 units (2022–Q1 2025), including 5,000+ units in Q1 2025 alone.

- Grade A supply surged to 38%, representing an 84% increase over previous stages, indicating growing demand for premium housing.

- 3 BHK units now lead the supply with a 50% share; 4 BHKs have also gained traction (10% share).

- Unit sizes have grown to 1,200–1,650 sq.ft., a 20% increase as compared to the previous stages, indicating a clear shift toward end-user preferences.

- Launch prices have also risen to ₹7,200–8,500 per sq. ft., a 45% increase from initial construction stage. The average ticket sizes now range between ₹90 lakhs and ₹1.3 crore, indicating a clear movement towards premium segment.

- The corridor is also witnessing improved social infrastructure growth, with the launch of M5 E-city Mall in Q4 2024—the first mall on Hosur Road—enhancing livability.

- Sales velocity has rebounded to 100–150 units/project/year, a ~45% improvement over pre-COVID levels. Grade A projects are outperforming, with double the average sales.

- Major launches include Brigade Valencia, Assetz Canvas and Cove, Prestige Southern Star, Prestige Suncrest, Purva Meraki, ARATT Ayatana Residences.

Metro’s Impact: A Market in Transition

Overall, the construction of the Yellow Line Metro has significantly enhanced the appeal of Hosur Road micro-market for end users. The area is undergoing a transformation from mid-segment to premium segment market. During the advanced construction stage, the share of Grade A supply tripled, and average annual absorption increased by ~35%.

The growing demand for larger, more premium homes has resulted in:

- 20% increase in average unit sizes

- 3 BHKs emerging as the dominant configuration

- Projects are witnessing 8–12% YoY appreciation based on their construction status.

Outlook

With the Yellow Line Metro operations expected by Q4 2025, the Hosur Road residential market is poised for further evolution. Based on trends observed in similar metro-influenced corridors like Kanakapura Road and Mysore Road, the following trends are anticipated in the 2025 -2027 period:

- Market Re-Positioning: Operation of the metro and advancing social infrastructure will lead to the growing demand for end-user homes in the region. With its increasing livability, the area shall be regarded as a premium residential market in coming years.

- Price Forecast: Property prices are projected to increase by ~15-20% YoY in 2026–2027, driven by improved accessibility and connectivity to the region.

- Supply: Average annual launches will range between 10,000–12,000 units. In 2025, Q1 alone recorded 5,000 new units, with an additional 4,300 units expected from top developers like Assetz, Lodha, and Sobha.

- Demand: Q1 2025 recorded ~2,300 sales, with full-year sales expected to surpass the 10,000 mark. Post metro operation, annual absorption is projected to rise ~45%, reaching 12,000–13,000 units/year.

- Product Configurations: 3 BHKs will remain dominant. Unit sizes are likely to expand further, averaging 1,200–1,800 sq.ft..

- Rise of Grade A Supply: Grade A projects are projected to contribute ~60% of new launches. As buyers look for premium homes, these projects are expected to capture the substantial share of demand.