Bengaluru’s retail landscape is undergoing a dynamic transformation, driven by a growing cosmopolitan population, shifting consumer preferences, rising disposable incomes, and the rapid expansion of e-commerce. The city is also emerging as the ‘High Street Shopping Capital of India.’

Organized retail malls account for 82% of Bengaluru’s retail inventory, while the remaining 18% is dominated by the top eight high streets. Notably, MG Road, Commercial Street, and Brigade Road rank among India’s top 10 high streets.

Bengaluru holds the second-largest mall inventory in India, with a per capita mall space of 1.16 sq.ft. The city’s retail infrastructure has expanded rapidly, doubling from approximately 9 million sq. ft. in 2015 to 18.2 million sq. ft. across 40+ malls by Q1 2025. Projections indicate further growth, with total mall stock expected to reach around 37 million sq. ft. by 2035.

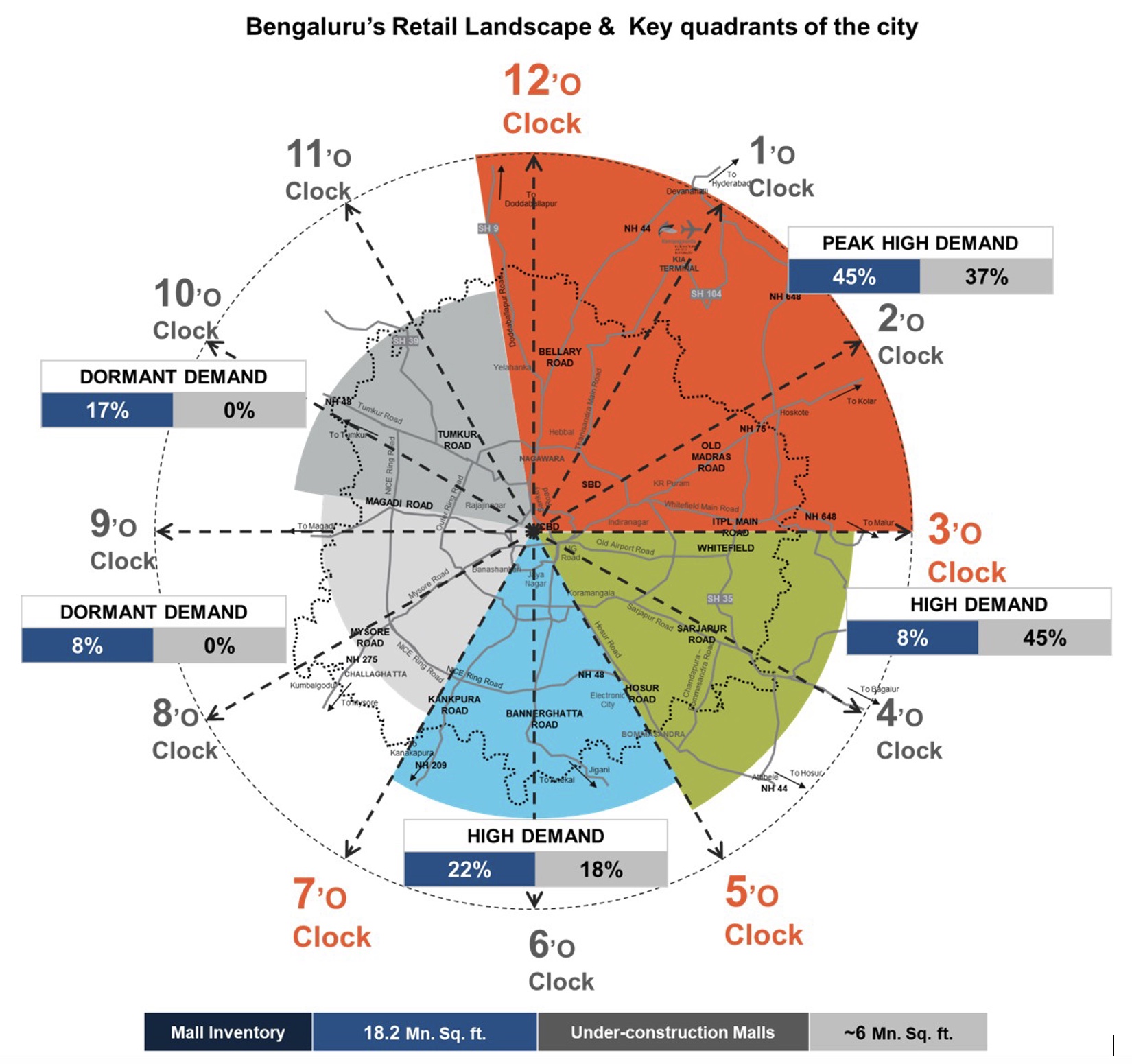

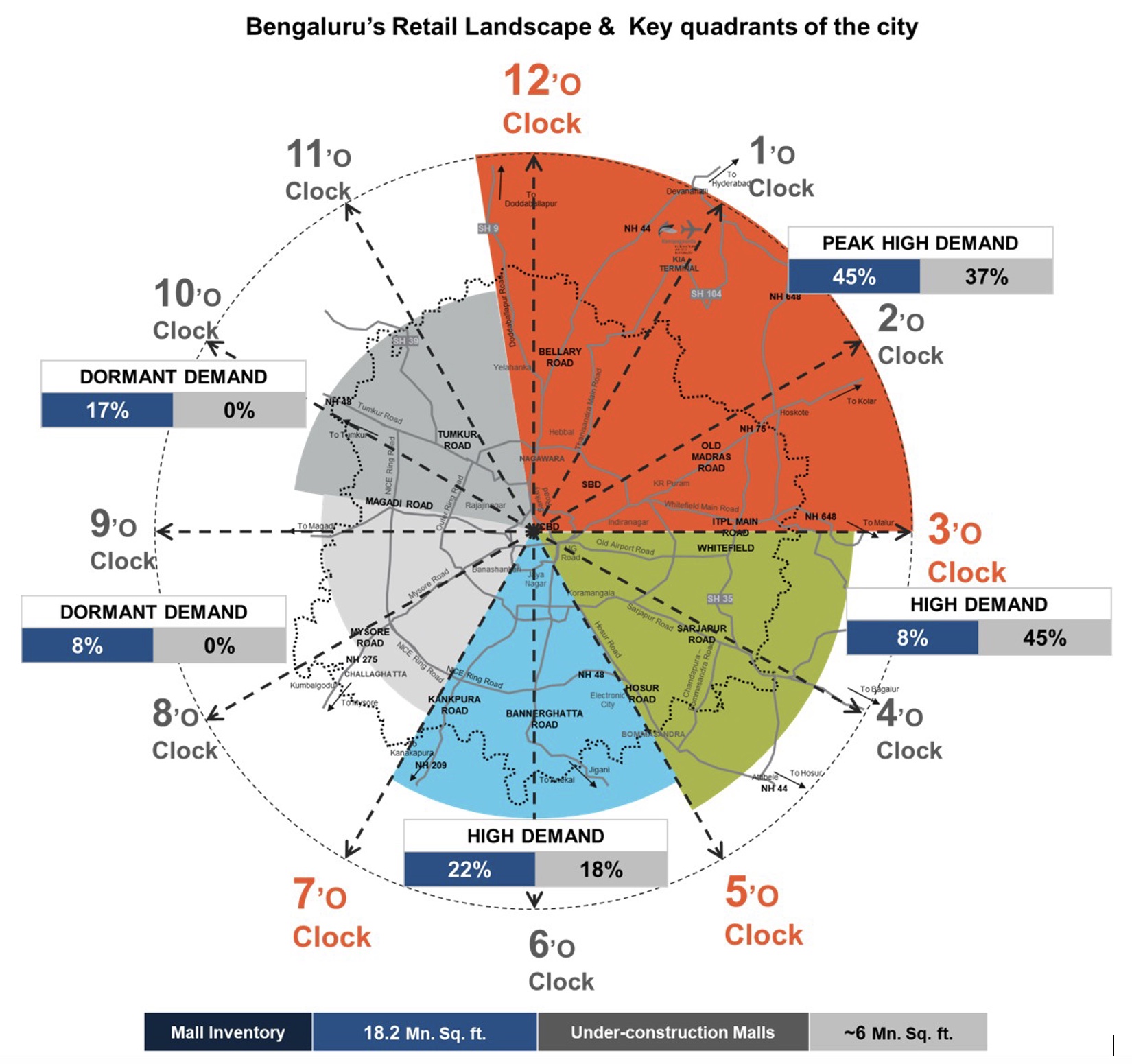

12'o to 3'o clock of the city: Surging Retail Quadrant

(Bellary Road to Whitefield Quadrant)

- The Bellary Road to Whitefield quadrant accounts 45% of Bengaluru’s total mall stock, featuring two malls exceeding 2 million sq. ft. each. Additionally, an additional 2 million sq. ft. of retail space is expected by 2027. This quadrant benefits from its strategic location near Kempegowda International Airport (KIA), while the upcoming metro connectivity further strengthens its retail potential.

- The Bellary Road stretch, especially near Hebbal, is a hub for premium residential and commercial office growth. It is also home to newly opened ‘Phoenix Mall of Asia’ having 1.2 million sq. ft. of gross leasing area. The upcoming Forum 13° North Mall will further enhance the retail landscape by adding approximately 700,000 sq. ft. of retail space.

- The Old Madras Road–Whitefield corridor is a prime commercial and residential hub with major tech parks and high-end residential developments. Key malls include Phoenix Market City (1 Mn. sq. ft.), VR Bengaluru, and Nexus Shantiniketan. Upcoming additions like Forum Mall at Park Grove and Brigade Cornerstone Utopia Mall will further strengthen its retail appeal.

3'o to 5'o clock of the city: Fast Growing Retail Hub

(Whitefield to Hosur Road Quadrant)

- The Whitefield to Hosur Road quadrant is rapidly evolving into a major retail hub. While it currently holds just 8% of the city’s mall inventory, but it leads all quadrants in under-construction mall supply, accounting for 45%.

- Its growth is driven by prominent tech parks and a strong residential market, fuelling demand for premium retail developments. Upcoming projects, including Forum Mall at Prestige Tech City and Ramson Trendsquare Mall, are set to add approximately 2.5 million sq. ft. of retail space to the quadrant.

5'o to 7'o clock of the city: Conducive Retail Eco-system

(Hosur Road to Kanakapura Road Quadrant)

- The Hosur Road to Kanakapura Road quadrant accounts for 22% of Bengaluru’s mall inventory, with top malls such as Vega City Mall, Nexus Forum Mall, Forum South Bangalore Mall, Mantri Arena Mall and Royal Meenakshi Mall. Upcoming developments, including M5 E-City Mall, will add approximately ~1 Mn. sq. ft. of retail space to the region.

- This quadrant attracts a diverse cosmopolitan population from premium residential areas. Increasing commercial developments in Electronic City and Bommasandra, combined with metro expansion on Kanakapura Road and improved road infrastructure, is enhancing connectivity and fuelling retail demand.

7'o to 12'o clock of the city: Dormant Retail Market

(Mysore Road | Magadi Road | Tumkur Road Quadrant)

- At present Mysore Road to Tumkur Road Quadrant accounts for 25% of city’s mall inventory with NIL upcoming supply proposed. Some of the notable retail developments like Orion Mall, Mantri Square and LULU Global Mall are located towards Tumkur Road quadrant. However, it remains a relatively dormant market within Bangalore’s Retail Landscape, with lower mall expansion compared to other parts of the city.

- Unlike other parts of the city, high-density residential clusters are yet to develop in this corridor. Traditionally an industrial hub dominated by Peenya and Yeshwanthpur industrial areas.

- Tumkur Road is now witnessing growing residential and commercial activity. Its proximity to the rapidly developing Hebbal zone is expected to drive its future potential.

Retail Outlook

Bengaluru’s retail landscape is undergoing a transformative shift, driven by evolving consumer preferences, rapid urbanization, and expanding commercial hubs. Over the past five years, the city's organized retail sector—comprising both malls and high streets—has seen a significant change in tenant mix, with an increasing share of leases in Apparel, Food & Beverage, and Entertainment, reflecting shifting lifestyle trends.

Retail Demand across City Quadrants

- Peak Demand (12’o to 3’o clock: Bellary Road to Whitefield Quadrant)

This quadrant has emerged as a prime location for mall development, fuelled by a well-established residential market, increasing commercial traction, and enhanced connectivity, making it a prime location for Mall development.

- High Demand (3’o to 7’o clock: Whitefield to Kanakapura Road)

Strong residential growth, existing commercial developments, and a cosmopolitan consumer base contribute to this region's significant retail potential. The area continues to attract large-scale retail projects catering to its affluent and diverse population.

- Dormant but Emerging (7’o to 12’o clock: Kanakapura Road to Bellary Road)

Currently a relatively dormant retail market, this quadrant is expected to gain traction as high-density residential developments take shape. Its proximity to the city's prominent economic hubs positions it as a future growth corridor for retail.

With ongoing infrastructure advancements, metro expansion, and improved road connectivity, Bengaluru is poised to solidify its status as one of India’s leading retail destinations. The city’s evolving demographics and rising consumer spending will continue to drive the next wave of retail growth, making it an attractive market for both national and international brands.