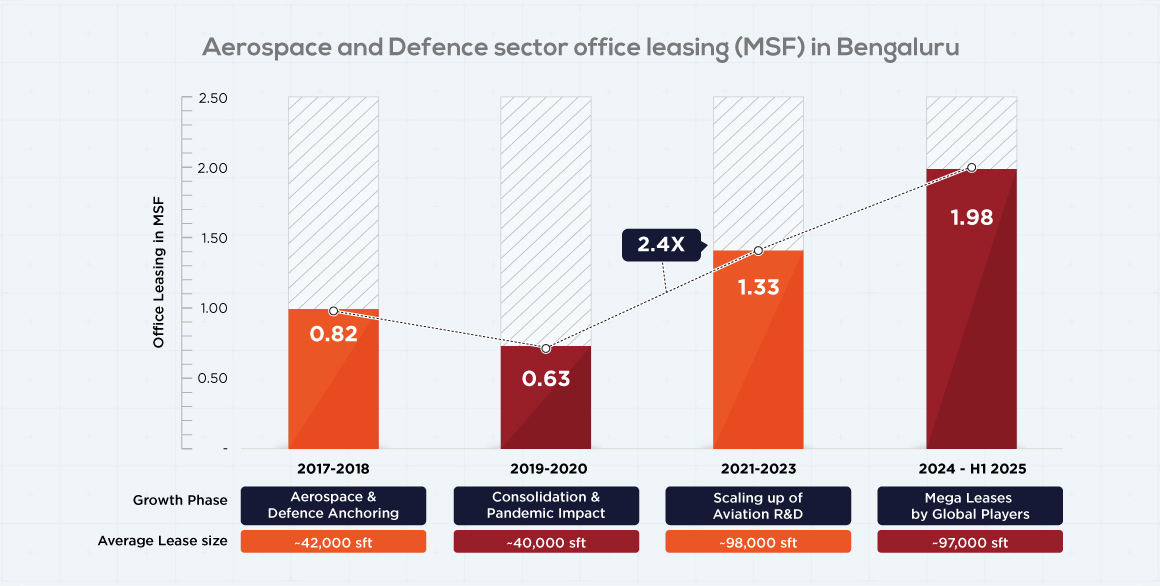

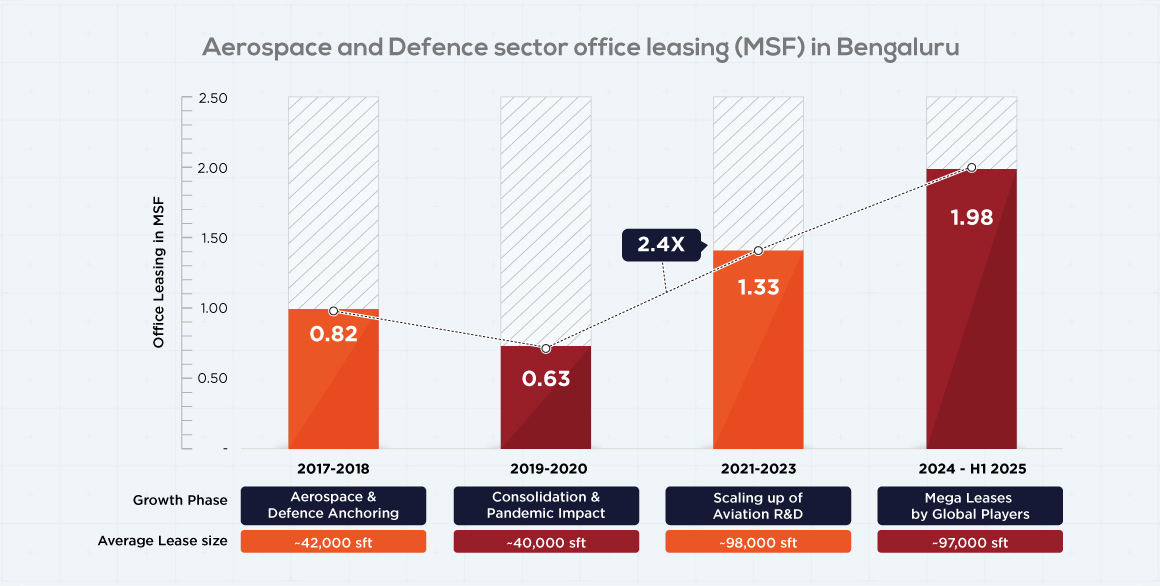

The city’s A&D sector has expanded significantly, with absorption rising from 0.82 million sq.ft. (2017–18) to 1.98 million sq.ft. (2024–H1 2025), recording an ~11% CAGR. Average lease sizes nearly doubled to ~96,000 sq.ft., reflecting a shift from pilot centres to large R&D campuses. ORR–East and North Bengaluru continue to anchor demand, driven by global OEMs, Tier-1 suppliers, and semiconductor majors.

Bengaluru has become India’s largest aerospace and defence (A&D) hub, with aviation R&D and aerospace engineering driving occupier demand. In the past decade the city’s ecosystem has evolved into combination of electronics & semiconductors manufacturing, chip design, avionics and space research. Push under Make-in-India programme and Defence offset norms have further strengthened such establishments. The Annual absorption has grown from 0.82 MSF in 2017-18 period to 1.98 MSF in 2024-H1 2025, with a ~11% CAGR since 2017. Average deal sizes increased from ~41,700 sq.ft. to ~96,400 sq.ft., indicating the demand has moved from mid-sized pilot centres to large scale Research & Development (R&D) centres and engineering hubs.

2017-2018: Aerospace and Defence Anchoring

- This phase laid the foundation for Bengaluru’s aerospace and defence leasing, with global OEMs and engineering service providers establishing their footprints in the city.

- Quest Global (3,30,000 sft), Rolls-Royce (1,14,000 k sft), and Boeing (~1,86,000 sft) led the leasing activity, supported by Thales, Honeywell, Moog, and TE Connectivity in avionics and aerospace electronics.

- Average lease size stood at ~41,700 sft, concentrated in ORR-east and North Bengaluru.

2019-2020: Consolidation and Pandemic Impact

- During this period, aerospace occupiers deepened their presence. Boeing expanded with a 1,60,000 sft lease in North Bengaluru and 45,000 sft lease in ORR.

- Collins Aerospace (70,000 sft), Textron (94,000 sft), and Veoneer (51,000 sft) were other major leases.

- Average lease size stood at ~39,800 sft., with leasing mainly driven for engineering activities.

- In 2020, Airbus and Collins Aerospace reinforced the ORR-east cluster, but leasing volumes dropped to ~75,000 sft due to the COVID-19 pandemic.

2021-2023: Scaling up of Aviation R&D

- This period saw a shift towards mega-block commitments of aviation & aerospace majors. The liberalistation of defence FDI to 74% through automatic route gave a major push.

- Collins Aerospace (3,15,000) and TE Connectivity (1,70,000 sft) led in 2021. Kongsberg and Pratt & Whitney expanded in 2022.

- In 2023 many semiconductor and avionics majors scaled up - Texas Instruments (1,20,000 sft), Onsemi (1,54,000 sft), and Ametek (75,000 sft) had the highest leasing volumes.

- Average lease size surged to ~97,600 sft as companies expanded their operations.

2024–H1 2025: Mega-Leases by Global Players

- The latest period has been the most transformative. Texas Instruments had a 5,50,000 sft mega-lease, followed by Renesas (1,06,000 sft) and Lufthansa Technik (52,000 sft).

- Startup establishments like Digantara and Exostar highlighted ecosystem depth in the city.

- In H1 2025 Airbus took 8,80,000 sft lease for its GCC - the largest A&D transaction in Bengaluru. Other players include Rolls-Royce, Siemens and TE Connectivity.

- Average lease size was ~96,400 sft, reflecting sustained demand for large, lab-ready R&D campuses.

Conclusion

- In Bengaluru the Aerospace and Defence sector’s leasing has evolved from pilot centres (~42,000 sft) to mega-block built-to-suit R&D centres (~96,000 sft).

- Major Locations preferred by these companies have been ORR-East and North Bengaluru, with ORR – East being the base for chip design and semiconductor majors and North Bengaluru being base for avionics, aerospace and defence R&D centres.

- These clusters offer both skilled talent pool and physical infrastructure suited to aerospace and defence companies.

- The occupier mix has shifted from engineering service providers to global OEMs, Tier-1 suppliers, and semiconductor leaders, reflecting Bengaluru’s growing role in aerospace and defence value chains.

Outlook

- Bengaluru’s A&D leasing is expected to sustain at ~ 0.5 – 1.0 MSF/year, supported by a robust pipeline of global and domestic occupiers.

- For developers, the focus will be on delivering large Built-to-suit campuses (~1,00,000 sft) with lab-ready specifications, high grade utilities, and enhanced security compliance.

- Aerospace and defence-linked assets offer long leases, premium rents, and reduced vacancy risks making it one of the most lucrative investments in current times.

- With global OEMs consolidating their R&D footprints and India promoting large number of next-generation aviation programmes like UDAN, NABH Nirman,etc. Bengaluru is set to remain the epicentre of aerospace and defence leasing in India.