Today, traditional fixed-income investments do not provide the desired returns as they did in the past. Real estate has been an integral part of an investor's portfolio primarily on account of stable cashflow returns, diversification benefits due to low correlation with other asset categories.

RE an attractive asset class for investment and will continue to be a preferred investment vehicle in future as well.

In India, real estate investments account for 25% -28% of portfolios of the HNIs and UHNIs.

Today, traditional fixed-income investments do not provide the desired returns as they did in the past. Real estate has been an integral part of an investor’s portfolio primarily on account of stable cashflow returns, diversification benefits due to low correlation with other asset categories.

As Indians, our inherent nature is to invest in tangible assets and an investment in real estate offers a pride of ownership unlike stocks and bonds. In addition, it is the only asset category that offers an option to increase potential returns by leveraging the asset and works as a hedge against inflation.

In India, Mumbai, Delhi NCR and Bangalore are among the most preferred cities for investments in real estate.

Among the real estate asset classes, most preferred asset classes are residential, commercial and land

- Investments in residential asset class accounts for nearly 65% of the total investments followed by commercial 25% and 10% in land.

- Capital requirement for a residential asset class is as low as INR 1 Cr making it a preferred asset class compared to commercial properties and land. In addition, residential properties are easy to maintain and offer higher ease of renting and selling as compared to commercial properties.

- Nearly 55% of the investments by HNIs and UHNIs are in the ticket size of INR 1 – 5 Cr, followed by INR 5 – 10 Cr which account for 35% of the investments. Most preferred asset classes for these equity options are residential and undivided share of commercial properties.

- Only 10% of the investments are in ticket size exceeding INR 10 Cr. For an investment size, exceeding INR 10 Cr investing in a commercial property and/or land are preferred – reasons being better returns in long term and increased leveraging capability.

- Returns from an investment in land will surpass returns from both commercial and residential properties, however, location, clear titled land and longer duration of investment is crucial to maximize the gains.

Residential is a best suited option for a 5-year horizon; commercial properties and land offer better returns over the period of 10 years

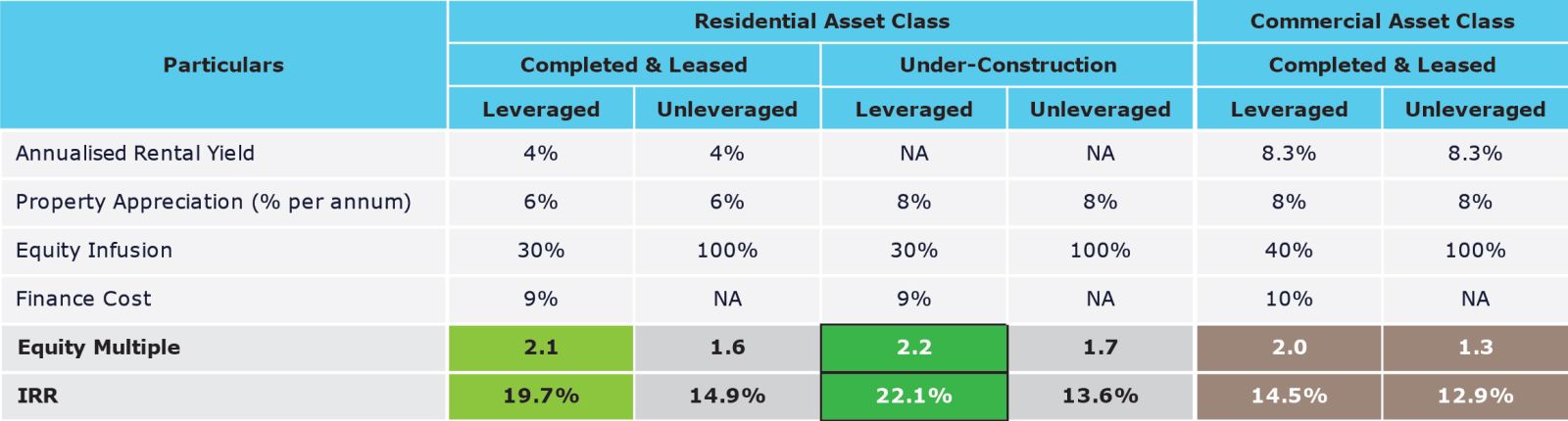

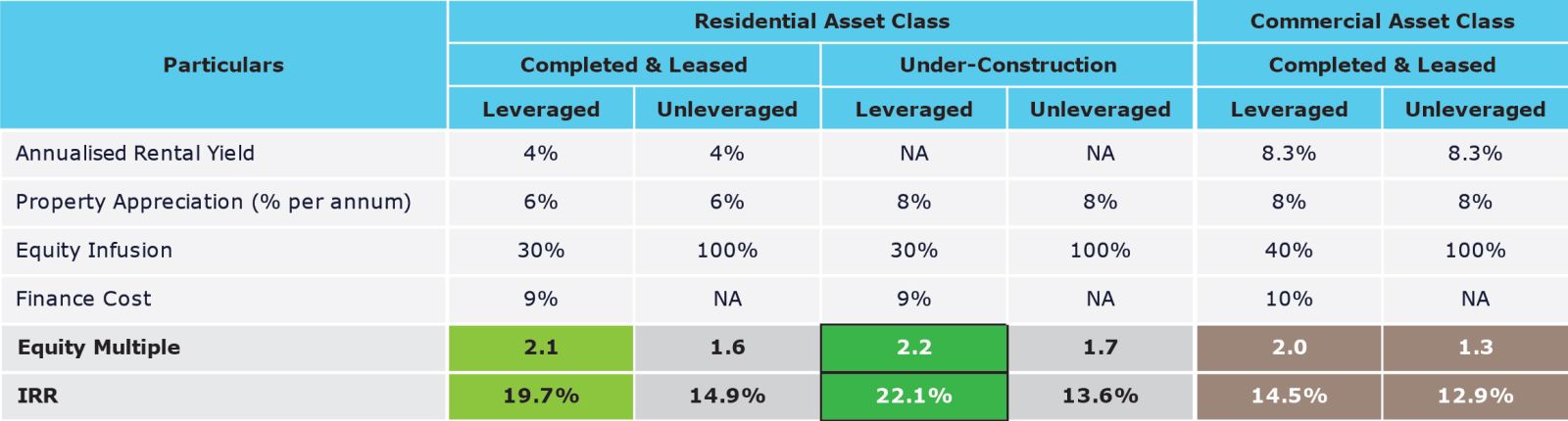

- For a 5-year horizon, leveraging an investment in an under-construction residential property is expected to fetch higher returns as compared to a completed residential or an office space property.

- Investment in land is expected to fetch annualized returns in the range of 25% - 40% over a period of 10-year horizon.

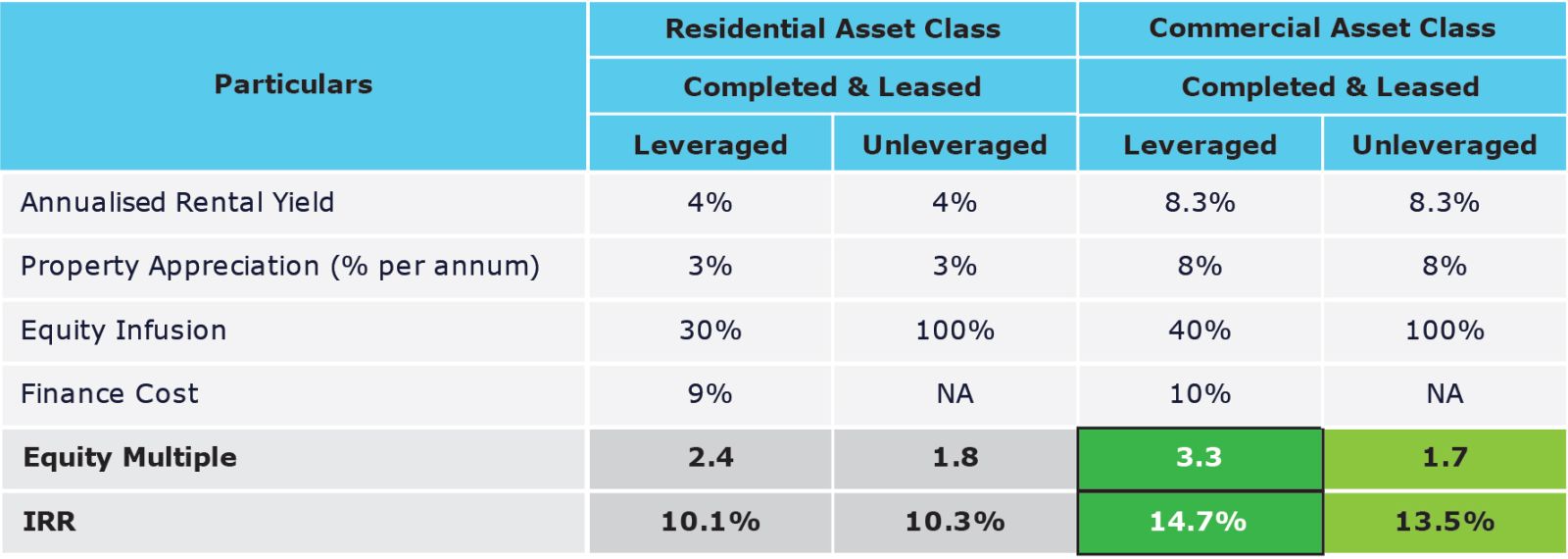

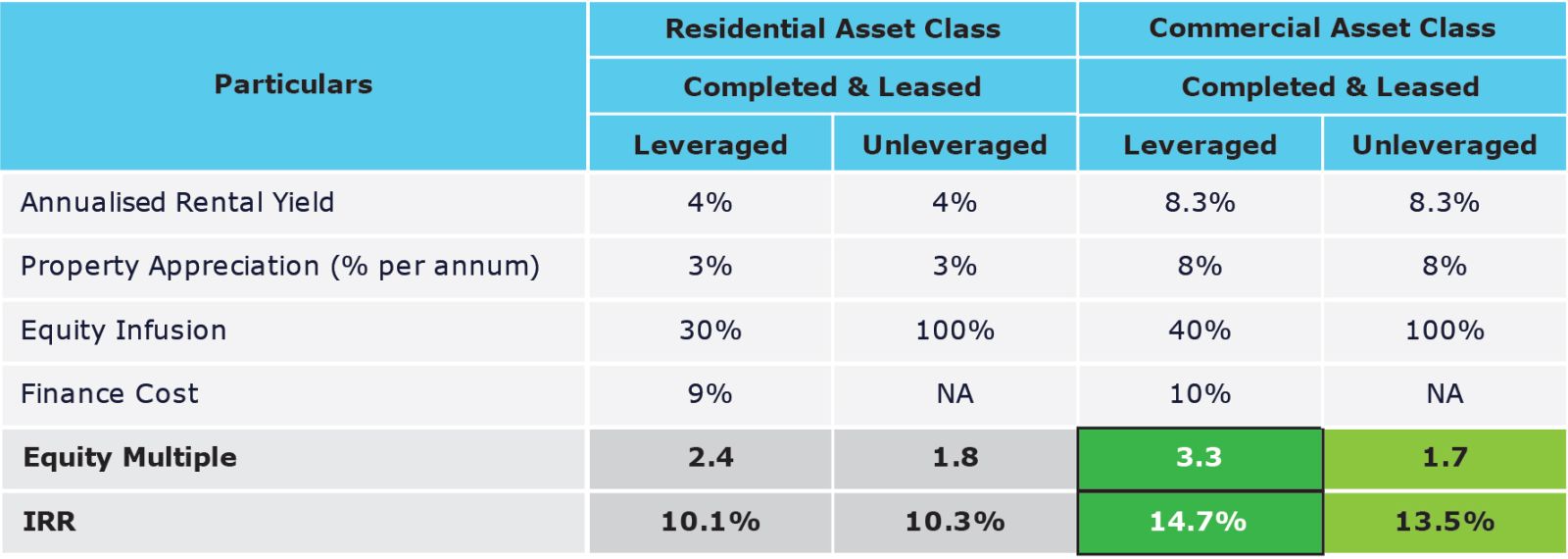

- A leveraged investment in office space is expected to give over 3X returns for a period of 10-year.

Returns1 for a 5-year Horizon

Returns1 for a 10 Year horizon

1 Indicate pre-tax numbers

- Property appreciation has been assumed at 8% for an under-construction residential property for the first 5 years

- For a completed residential property, property appreciation is assumed as 6% for the 0 -5 years and 3% for the subsequent 5 – 10 years.

- Stamp Duty and registration costs have been assumed at 7% of the property value.

- Sale of the property has been assumed at the end of the investment period

- Cost towards property maintenance and repairs is not considered while computing returns for 10-year horizon

Going forward, real estate will continue to remain one of the most preferred asset class for investments

- With implementation of REITs, share of investments in commercial asset class is expected to increase by 10% - 15% mainly due to lower ticket size and ease of exit. REITs are also likely to help in geographic diversification of the RE portfolio thereby minimizing risks

- Reduction in inflation rates and compressing yield rates are expected to further improve the return profile for real estate market.

- Further, policy level changes like – implementation of RERA and GST are expected to increase transparency in the real estate industry. Going forward real estate sector will continue to be one of the preferred asset classes for investments by both HNIs and UHNIs.

- Apart from Mumbai, Delhi NCR and Bangalore; Hyderabad and Pune are likely to witness increased interest from investors.

About the Author

![Dhara Shah]()

Dhara Shah

Dhara has over 17 years of experience in Real Estate Investment and Consultancy. She has executed deals worth USD 10 million and led the team on executing 100 valuation assignments in the last 3 years. Prior to joining Meraqi she has worked with Vestian, UGL Equis and BPCL. Dhara is B.E (Civil) from S.V.NIT, Surat M.Tech (Infrastructure Planning) from CEPT, Ahmedabad.