4th January 2018

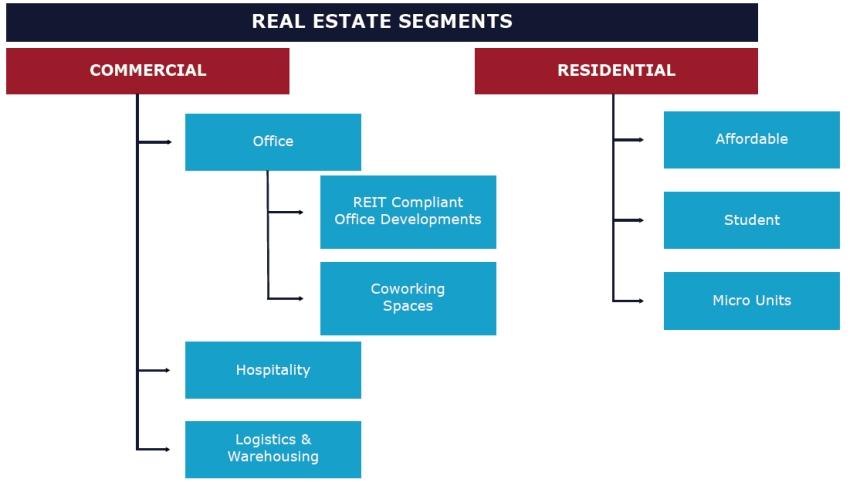

Opportunities in traditional real estate segment will remain, however, newer segments will witness increased interests and investments on account of huge untapped demand.

| OPPORTUNITY IN COMMERCIAL SEGMENT | |||

| Segment | REIT Compliant Developments | ||

|---|---|---|---|

| Target Segment |

|

||

| Bangalore | Chennai | Hyderabad | |

| Current Market Scenario |  86.2 million sqft (52%) of office stock is eligible for REIT listing. 86.2 million sqft (52%) of office stock is eligible for REIT listing. |

27.2 million sqft (41%) of office stock is eligible for REIT listing. 27.2 million sqft (41%) of office stock is eligible for REIT listing. |

28.4 million sqft (50%) of office stock is eligible for REIT listing. 28.4 million sqft (50%) of office stock is eligible for REIT listing. |

| Why Opportunity? |

|

||

| Key Locations |  Outer Ring Road, Whitefield & Bangalore North with high component of REIT eligible stock Outer Ring Road, Whitefield & Bangalore North with high component of REIT eligible stock |

OMR OMR |

HITECH City, Gachibowli HITECH City, Gachibowli |

| OPPORTUNITY IN COMMERCIAL SEGMENT | |||

| Segment | Coworking | ||

|---|---|---|---|

| Target Segment |

|

||

| Bangalore | Chennai | Hyderabad | |

| Current Market Scenario |  1.4 million sqft of coworking space 1.4 million sqft of coworking space |

0.2 million sqft of coworking space 0.2 million sqft of coworking space |

0.3 million sqft of coworking space 0.3 million sqft of coworking space |

|

|||

| Why Opportunity? |

5.6 million sqft of additional coworking requirement by 2022 5.6 million sqft of additional coworking requirement by 2022

|

0.6 million sqft of additional coworking requirement by 2022 0.6 million sqft of additional coworking requirement by 2022

|

2.1 million sqft of additional coworking requirement by 2022 2.1 million sqft of additional coworking requirement by 2022

|

|

|||

| Key Locations |

|

OMR, Guindy, Nugambakkam OMR, Guindy, Nugambakkam |

Hitech City, Gachibowli, Jubilee Hills, Kukatpally, Kondapur Hitech City, Gachibowli, Jubilee Hills, Kukatpally, Kondapur |

| OPPORTUNITY IN COMMERCIAL SEGMENT | |||

| Segment | Hospitality | ||

|---|---|---|---|

| Bangalore | Chennai | Hyderabad | |

| Target Segment |  Business Travelers from IT/ITES sector Business Travelers from IT/ITES sector |

Business Travelers & MICE Business Travelers & MICE |

Business Travelers from IT/ITES sector, MICE & Weddings Business Travelers from IT/ITES sector, MICE & Weddings |

| Current Market Scenario |

|

|

|

| Why Opportunity? |

|

|

|

| Key Locations |

|

OMR, Mount Road, Egmore OMR, Mount Road, Egmore |

In proximity to the business districts like HITECH City, Gachibowli & Banjara Hills In proximity to the business districts like HITECH City, Gachibowli & Banjara Hills |

| Segment | Logistics & Warehousing | ||

| Target Segment |  Industrial & Retail sectors are the key drivers Industrial & Retail sectors are the key drivers |

||

| Bangalore | Chennai | Hyderabad | |

| Current Market Scenario |

|

10.9 million sqft of warehousing stock 10.9 million sqft of warehousing stock |

9.2 million sqft of warehousing stock 9.2 million sqft of warehousing stock |

| Why Opportunity? |

|

|

|

| Key Locations |

|

Walajabad, Mappedu, Sunguvarchatram, Mannur on the Sriperumbudur-Oragadam-Maraimalai Nagar & Periyapalayam-Gummidipoondi clusters Walajabad, Mappedu, Sunguvarchatram, Mannur on the Sriperumbudur-Oragadam-Maraimalai Nagar & Periyapalayam-Gummidipoondi clusters |

Medchal-Dandupally & Shamshabad, Kothur – Turkapally cluster Medchal-Dandupally & Shamshabad, Kothur – Turkapally cluster |

| OPPORTUNITY IN RESIDENTIAL SEGMENT | |||

| Segment | Affordable Housing | ||

|---|---|---|---|

| Target Segment |

|

||

| Bangalore | Chennai | Hyderabad | |

| Current Market Scenario |

|

|

|

| Why Opportunity? |

|

|

|

|

|||

| Key Locations |

|

OMR, Avadi, Oragadam, GST Road OMR, Avadi, Oragadam, GST Road |

Miyapur, Shadnagar, Maheshwaram, Pocharam Miyapur, Shadnagar, Maheshwaram, Pocharam |

| OPPORTUNITY IN RESIDENTIAL SEGMENT | |||

| Segment | Student Housing | ||

|---|---|---|---|

| Target Segment |

|

||

| Bangalore | Chennai | Hyderabad | |

| Current Market Scenario |

|

|

|

|

|||

| Why Opportunity? |

|

|

|

| Locations |

|

||

| OPPORTUNITY IN RESIDENTIAL SEGMENT | |||

| Segment | Micro-Unit Housing | ||

|---|---|---|---|

| Target Segment |

|

||

| Bangalore | Chennai | Hyderabad | |

| Current Market Scenario |

|

|

|

| Why Opportunity? |

|

|

|

|

|||

| Locations |

|

||

|

|

|

|