2nd May 2019

India’s first Real Estate Investment Trust (REIT) - Embassy Office Parks’ REIT – backed by realty developer Embassy Group and US-based Private Equity firm Blackstone Group LP, raised INR 4,750 Cr through issue of units at INR 300 a unit.

Encouraging investor response has highlighted the potential of an investment product which was not yet available in India. The success of Embassy Office Parks’ REIT is likely to boost fresh investments in commercial realty and increase in REIT listings; giving developers ability to raise resources through the monetisation of rent yielding properties at a relatively attractive cost.

Key factors that can be attributed towards success of Embassy Office Parks’ REIT are:

REITs:

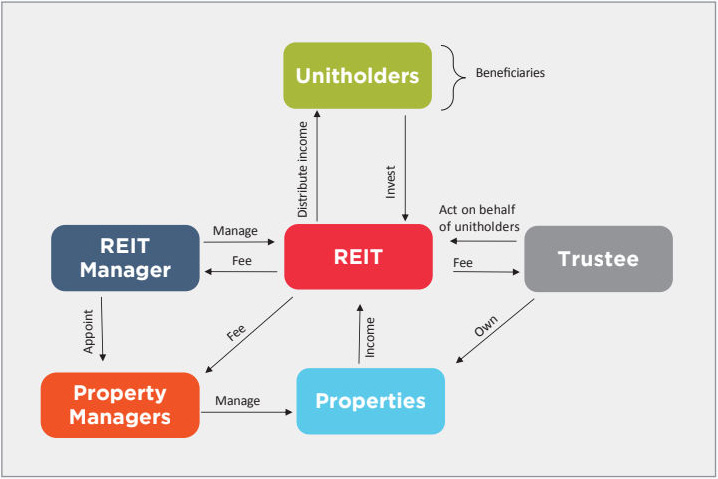

REITs are companies that own or invest in income-producing real estate in a range of property sectors. REITs work like a mutual fund by pooling funds from investors and investing them in rent-generating properties, mostly commercial (office, shops, malls and hotels).

REIT will be set up as a Trust under the Indian Trusts Act, 1982 and has to be registered with Securities and Exchange Board of India (SEBI). REIT to hold specified assets:

REIT for a real estate developer is an alternate funding mechanism that provides liquidity and for an investor it is access to high value real estate and earn fixed returns. Returns on REITs accrue from yield as well as appreciation in the unit price.

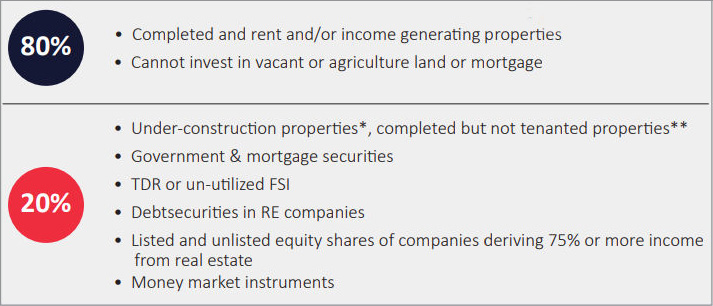

Assets in which REIT can invest :

* To be held by REIT at least for 3 years after completion

** To be held by REIT for at least 3 years from date of purchase

Benefits of REIT to various stakeholders:

REIT offers an organized platform for real estate investment which is professionally managed and ensures protection of investor interests. Success of first REIT in India will have a positive impact on the Indian real estate sector.

Subsequent blog to discuss about returns on investment in REIT