3rd December 2024

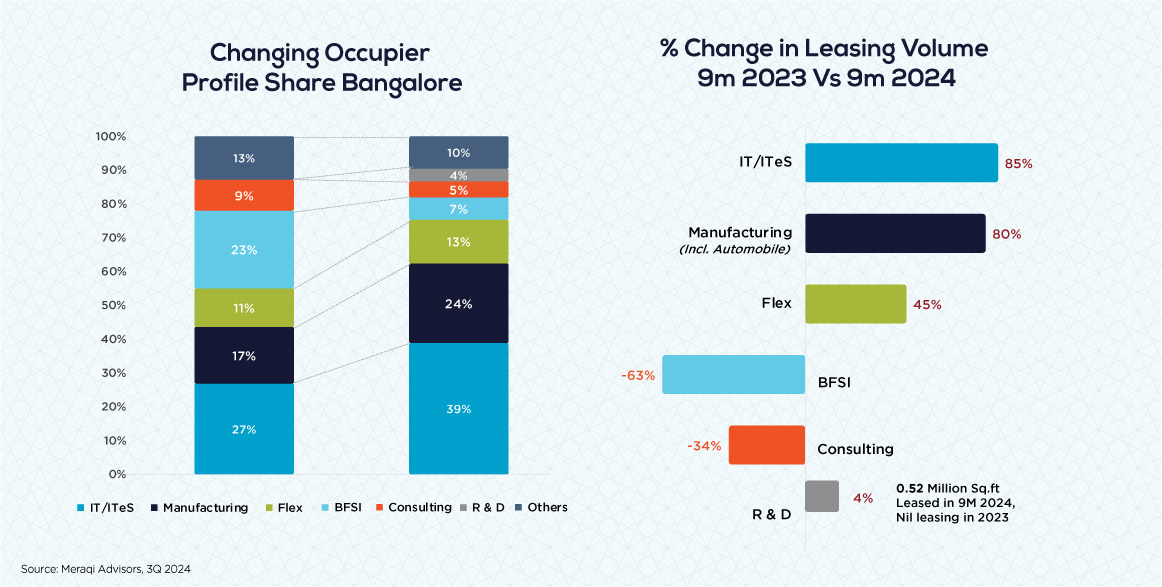

Bangalore, India's tech capital, has always attracted a dynamic mix of industries, but recent data highlights an intriguing changing occupier profile across the city. Analysing office absorption for 9M 2024 compared to the same period in 2023, we can see significant growth in some sectors and contractions in others. Let’s explore how occupier demands are shifting and what this means for Bangalore’s commercial real estate market

1. IT/ITeS Leads the Growth with an 85% Surge

Major Occupiers (9M 2024): Walmart, Google, IBM, Databricks, Quest Global, Salesforce, Synopsys MathCo, Computacenter, Atlassian, Omnissa etc.

The IT/ITeS sector’s expansion in Bangalore aligns with growth in other major Indian cities, making a strong comeback over the past two years, particularly in Hyderabad, Pune, and Delhi-NCR.

2. Manufacturing Sector Gains Momentum with an 80% Increase

Another surprising standout is Manufacturing (incl. Automobile), which saw an 80% rise in lease volume compared to the same period in 2023. Bangalore has been nurturing its manufacturing base, especially in high-tech and industrial manufacturing, and this growth aligns with India’s “Make in India” and “Atmanirbhar Bharat” initiatives. Bangalore’s manufacturing growth is fuelled by rising demand, tech-industry synergy, supportive government policies, and proximity to R&D, making it a prime location for high-tech production and innovation integration.

Major Occupiers (9M 2024): Bosch, HP, Sony, Tektronix, Tata Agratas, Mercedes Benz, Jaguar Land Rover, Stryker Global, Daimler Truck, Hitachi Energy, Tejas Networks, Western Digital, Sagility etc. Manufacturing has seen significant growth in Bangalore, even as the sector's national share slightly declines, with companies increasingly preferring cities like Bangalore and Chennai.

3. Flex Spaces Gain Momentum: A 45% Increase

The Flex space segment has witnessed a 45% increase in lease transactions compared to the same period in 2023 - as companies increasingly seek flexible, scalable office solutions. Offering coworking and managed offices, flex spaces are now favoured by startups, small businesses, and even larger companies prioritizing agility and cost-efficiency over traditional long-term leases. This shift highlights a modern business mindset focused on flexibility and collaborative environments, appealing especially to talent drawn to community-focused amenities valued by millennials and Gen Z.

Major Occupiers (9M 2024): Tablespace, Indiqube, Wework, Urban Vault, Luxworks, Workshaala, Simpliwork & Isprout etc.

Bangalore has seen substantial growth in the flex space sector, outpacing the marginal increase at the national level. The sector continues to reach new highs, primarily concentrated in cities like Bangalore, Hyderabad, Delhi, and Pune.

4. Challenges for BFSI and Consulting Sectors

Interestingly, while some sectors are expanding, traditional office occupiers like Banking, Financial Services, and Insurance (BFSI) and Consulting are showing signs of contraction - transactions dropped by 64% & 34% respectively. The digital shift and adoption of remote work are reducing demand for large office spaces in sectors like BFSI and consulting, which now favour smaller, flexible workspaces.

Major Occupiers (9M 2024): NatWest, PayPal, Kotak Mahindra, Bank of America, Deloitte, Genpact, Ernst & Young, WSP, & ANSR etc.

While the BFSI and Consulting sectors are shrinking in Bangalore, significant growth is being observed in other major Indian cities, with Mumbai, Hyderabad, Pune, and Chennai seeing high concentrations.

5. R&D Sector Gains Momentum with a 4% Share

The R&D sector contributes 4% of the total occupier profile in 9M 2024, showing a new focus compared to its absence in the earlier period. The demand driven by a skilled talent pool, tech-manufacturing synergy, and supportive government policies. Industries like life sciences, AI, innovative, Medical Devices and high-tech engineering are fuelling demand for state-of-the-art, collaborative spaces.

Major Occupiers (9M 2024): Syngene International, Amadeus Labs, Eco Lab & Baxter (R&D Centre).

The R&D sector's growth in Bangalore aligns with trends in other leading Indian cities, showing strong momentum as seen in Hyderabad, Pune, and Delhi-NCR - as these hubs attract increasing investments in innovation-driven industries such as IT, life sciences, and advanced manufacturing.

CONCLUSION: ADAPTING TO AN EVOLVING OCCUPIER PROFILE

The changing occupier profile in Bangalore’s commercial real estate market reflects the broader changes across industries. Tech-driven sectors like IT/ITeS, Manufacturing, Flex and R & D spaces are thriving, driven by technological advancements, talent availability, and the flexibility that the modern workforce demands. In contrast, traditional sectors like BFSI and Consulting, are consolidating or adopting more flexible workspace solutions to adapt to evolving business models. This trend offers valuable insights for developers, investors, and landlords looking to stay ahead. Here’s how they can adapt to meet the demands of this evolving market:

1. Invest in High-Quality, Tech-Enabled Office Spaces: With the IT/ITeS and Manufacturing sectors driving demand, offering state-of-the-art facilities and advanced amenities will be essential. Developers should prioritize high-quality, tech-enabled office spaces that deliver seamless connectivity, modern infrastructure, and flexible, collaborative zones optimized for hybrid work environments.

2. Expand Flex Space Offerings: Flex spaces have become indispensable for businesses seeking adaptability. Providing customizable, plug-and-play solutions with flexible, short-term lease options with collaborative and creative environments will attract startups and mid-sized companies, enabling them to quickly adapt to evolving needs.

3. Understand Sector-Specific Needs: Developers should pay close attention to sector-specific demands – for instance, R&D facilities for Automotive or Manufacturing companies looking for proximity to tech ecosystems.

4. Reimagine Spaces for BFSI and Consulting Sectors Moving Towards Hybrid Models: Developers can respond by creating multi-purpose spaces with shared meeting rooms, hot-desking options, and collaborative zones - can appeal to these occupiers’ cost-conscious and adaptive strategies.

5. Consider Innovative R&D Spaces to Support Automotive Transformation: Collaborating with automotive companies to develop customizable lab spaces, EV testing zones, and specialized equipment support could attract this sector as it transitions from traditional manufacturing to next-generation automotive research.

By understanding and responding to these shifting occupier profiles, Bangalore’s commercial real estate developers and investors can stay ahead in a dynamic market. Adapting spaces to sector-specific needs, embracing flexibility, and prioritizing sustainability will not only attract a diverse mix of occupiers but also position Bangalore as a leading destination for forward-thinking businesses across industries.