5th July 2017

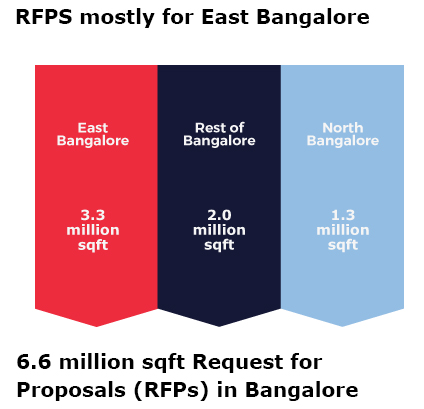

East Bangalore comprising of Outer Ring Road (KR Puram to Iblur), Sarjapura Road, Varthur and Whitefield micro-locations has emerged as prime office destination and accounts for 47% of the commercial office stock in the city. Most of the IT/ITES companies in Bangalore have large office set-ups in East Bangalore and prefer the location for expansion and consolidation.

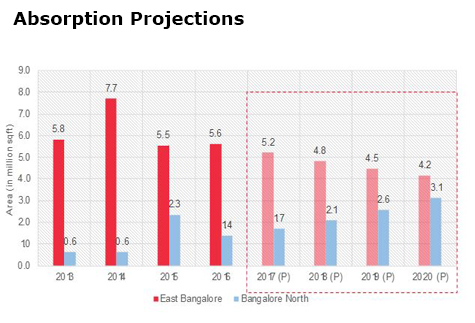

Post commencement of Kempegowda International Airport in Devanahalli, micro-locations of Hebbal, Bellary Road, Yelahanka, Devanahalli and Thanisandra in North Bangalore are witnessing major activity in the commercial office space segment. There has been a significant (125%) growth in the office space absorption during 2013-2016 in North Bangalore and correspondingly, huge supply is lined up in these locations.

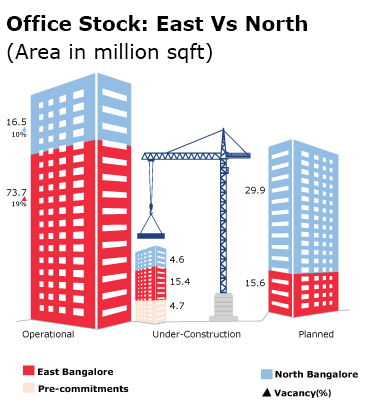

IT/ITES companies are also consolidating their operations in Built-to-Suit campuses in the city. Currently, 5.4 million sqft of Built-to-Suit campuses are under-construction in Outer Ring Road and 0.8 million sqft of captive campus in North Bangalore.

Upcoming supply in North Bangalore is primarily concentrated along Bellary Road stretch (Hebbal-Yelahanka). There are land banks of all prominent commercial office space developers in North Bangalore. In addition to the planned supply of 29.9 million sqft in North Bangalore, 315 acres of land is banked for future commercial development. East Bangalore has 238 acres of land banks concentrated in Whitefield micro-location.

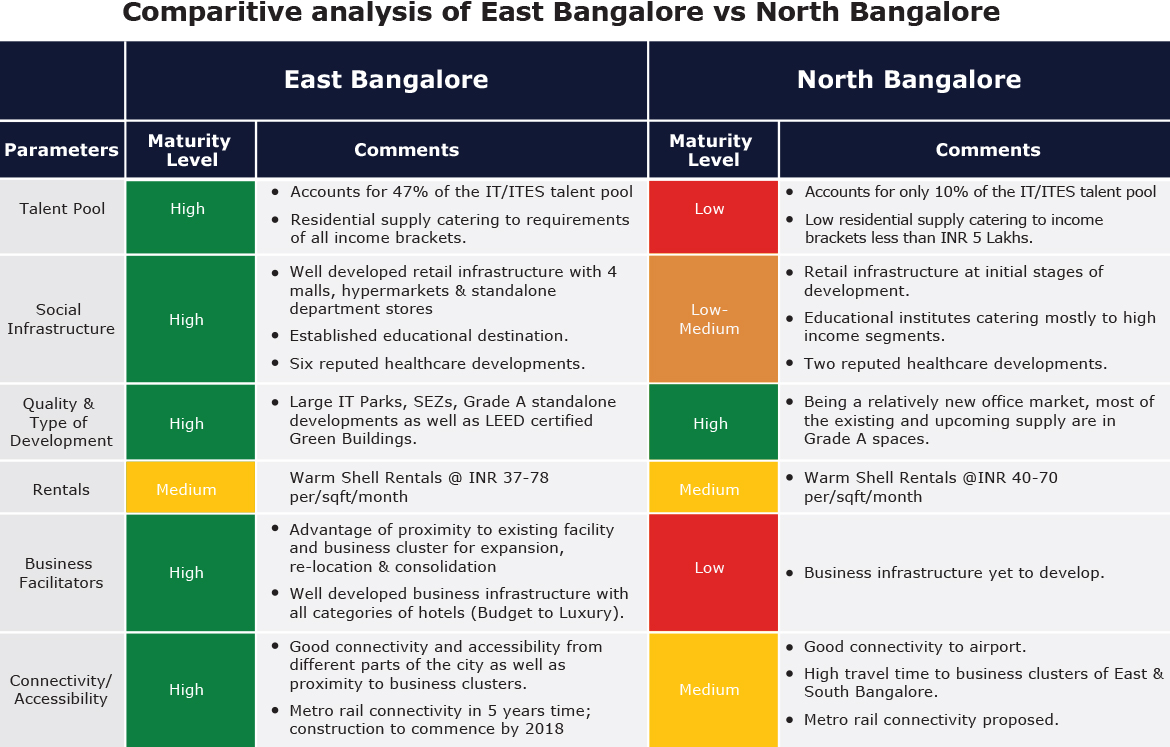

Currently, the rentals in North Bangalore are at par with East Bangalore.

North Bangalore:

East Bangalore:

Talent Pool, Social Infrastructure, Quality & Type of Development, Rentals, Business Facilitators and Connectivity/ Accessibility are key determining factors for occupiers in selecting a location for setting up of an office.

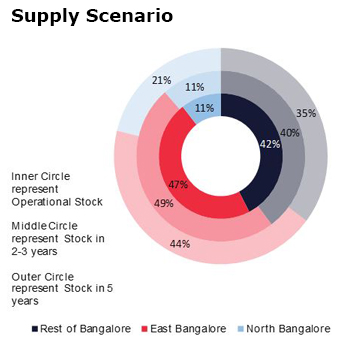

East Bangalore will continue to remain as the preferred office destination; however, due to lesser under-construction & planned stock, the supply options will saturate in 5-7 years time assuming annual absorption continues to average at 5 million sqft in the micro-locations.

North Bangalore will witness a major improvement in residential, social and business infrastructure by 2022.

Post 2022, most of the planned projects in the location will witness completion leading to an increase in the share of office stock from the current level of 11% to 21% thereby facilitating a gradual increase in demand for North Bangalore.